As we reach the halfway point of 2025, the latest Artnet Intelligence Report provides an important snapshot of the global art market. It shows clear shifts that will shape the way galleries, collectors, and institutions operate in the coming months.

The art market today is not defined by a single direction, but rather by contrasts: between the thriving high-end and the struggling middle, between traditional markets and new geographies, and between the transparency of auctions and the privacy of tailored sales. For galleries, understanding these contrasts is the key to navigating opportunities and challenges.

A Market of Contrasts

The overall message is one of stability with nuance. High-value sales are still strong: so far this year, art sales have declined in nearly every price range save one, the $1 million- to-$10 million bracket. That segment realized $1.6 billion, a 13.8 percent increase from the same period last year. It was also the only one to see an uptick - around 6.7 percent—in the number of works sold versus the first half of 2024.

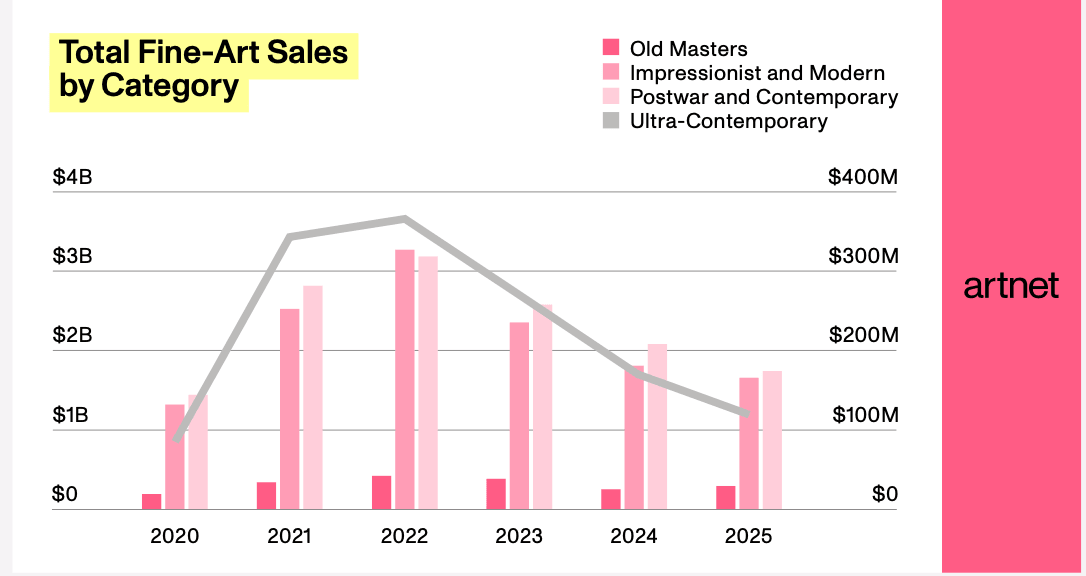

Total fine art sales by category © Artnet

Postwar and contemporary remained the most lucrative category, generating just over $1.8 billion in sales in the first half of the year. These works are driving the headlines and setting the benchmarks for confidence in the market. Star designer François-Xavier Lalanne accounted for two spots on the list of top 10 postwar works at auction in the first half of 2025. His monumental rhinoceros-shaped desk more than tripled its high estimate at Sotheby’s New York in June after a 13-minute bidding war. Jean-Michel Basquiat, as usual, dominated the list of contemporary trophies, accounting for six of the top 10 slots.

The category that saw the most contraction was ultra-contemporary, yielding just over $117.2 million in total sales, a 31.3% drop from the equivalent period last year. This sector has cooled significantly amid the market contraction of the past two years, and fewer ultra-contemporary pieces (defined as those by artists born after 1974) hit the auction block. For example Beijing-born artist Huang Yuxing’s 2017 painting Majestic Mountains and Ripping River (Set of 4), in his signature Day-Glo palette, fetched $5.1 million at his native city’s China Guardian Auctions in May, far exceeding its high estimate.

Jean-Michel Basquiat, Untitled III (from The Figure portfolio), 2023 available on Artsper

At the same time, the middle market is under pressure. Collectors are approaching purchases with greater selectivity, carefully weighing an artist’s institutional presence and market track record. This is a shift from the speculative frenzy of just a few years ago, when young artists could see their prices skyrocket overnight. Today, the focus has returned to quality and sustainability.

What is especially notable is the growing presence of female and non-Western artists. Their inclusion in museum exhibitions, gallery rosters, and sales catalogues is no longer an exception but a structural trend. For example 13 women were included in the 100 top top-selling fine artists at auction. That’s up from 10 in the same period last year. Only one woman (Yayoi Kusama) appears in the top 20. For galleries, this signals a clear opportunity: to broaden representation in a way that not only reflects collector demand but also aligns with the institutional narratives that shape long-term value.

Yayoi Kusama, Pumpkin (yellow), Circa 2021 available on Artsper

Regional Dynamics

The regional breakdown further highlights the market’s uneven performance.

- United States: The U.S. remains the engine of the high end, particularly in New York, where evening sales confirmed strong appetite for museum-quality works. For galleries with international ambitions, the U.S. continues to be the safest ground for high-value transactions.

- Europe: Despite broader economic concerns, London and Paris have shown remarkable resilience. Major fairs and the strength of cultural institutions continue to stimulate collector engagement. Paris, in particular, has consolidated its role as a global hub, offering new opportunities for galleries seeking visibility.

- Asia: Hong Kong and mainland China, once considered the fastest-growing art markets, are currently facing headwinds. Weaker currencies and slower economic growth have tempered demand, leading to more cautious buying. While the long-term potential remains undeniable, the short-term requires prudence and careful strategy.

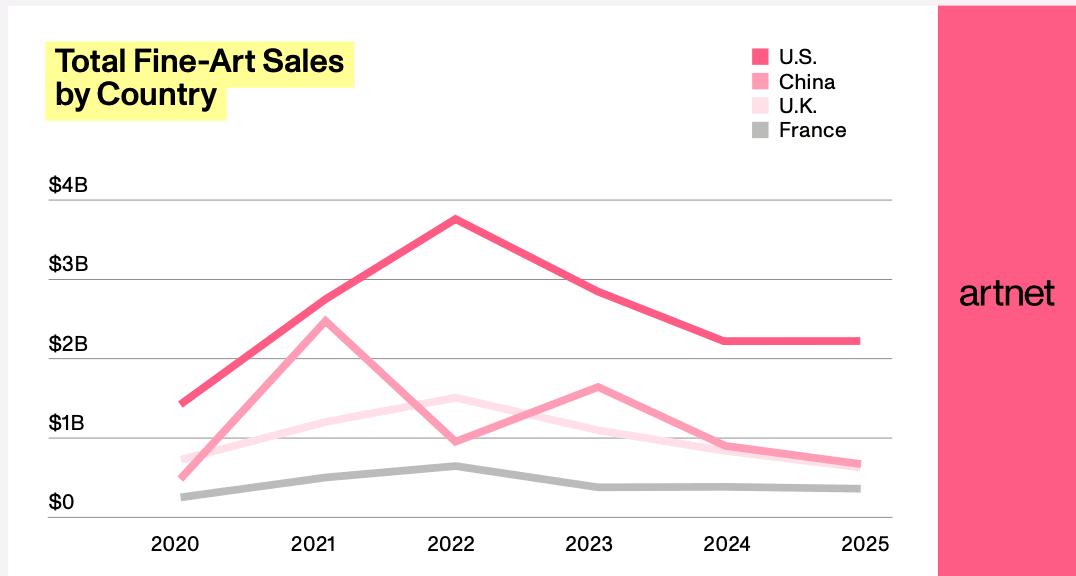

Total fine art sales by country © Artnet

For galleries, this means that growth lies in balancing geographic focus—leaning into resilient Western markets while maintaining a long-term presence in Asia without overcommitting in the immediate future.

Auctions, Private Sales, and the Role of Galleries

One of the most important trends highlighted is the shift in collector behavior between public and private channels.

Auction houses have continued to deliver strong results at the high end, but many top collectors are increasingly choosing private sales. For these buyers, discretion, personal relationships, and carefully curated opportunities are more attractive than the visibility of public auctions.

This is where galleries hold a strategic advantage. A gallery is not only a seller of works but also a trusted advisor and a long-term partner for collectors. The ability to guide clients, anticipate their interests, and secure access to exceptional works reinforces the central role of galleries in a market where trust and exclusivity matter more than ever.

Digital Presence: From Optional to Essential

Another key point from the report: digital is no longer a question of innovation—it is the standard expectation. Online and hybrid sales have stabilized since their pandemic-era surge, but collectors now see them as part of the normal buying journey.

Buyers expect:

- Seamless digital catalogues with professional photography and detailed information.

- Transparent, data-driven insights into pricing and provenance.

- Reliable access to works through online platforms before they commit to a purchase.

For galleries, this means investing in digital is not simply about reaching more people. It is about building credibility and trust. The first impression of a gallery often comes through its online presence, long before a collector walks through the door or visits a fair booth.

Key Takeaways for Galleries

Double Down on Quality

The strongest sales confirm that quality and reputation drive value. Focus on artists with established or building institutional backing, as collectors are increasingly risk-averse.

Embrace Diversity

Female and non-Western artists are not just a trend but a structural shift. Expanding representation opens new opportunities with both collectors and institutions.

Prioritize Client Relationships

With private sales on the rise, personalized engagement, trust, and curatorial guidance are key assets for galleries.

Strengthen Digital Standards

Collectors expect digital excellence. From professional visuals to transparent information, the way works are presented online directly impacts sales potential and relying on digital platform like Artsper is essential.

David Hockney, Title Page (from the Blue Guitar portfolio), 1977 available on Artsper

Looking Ahead

The art market is going through a period of uncertainty, and some dealers are experimenting with new models to adapt. Leo Koenig, a New York gallerist with 30 years of experience, has adopted a three-pronged approach: a small gallery on the Upper East Side, seasonal activity in Palm Beach, and a temporary gallery in Andes, in the Catskills, where he offers collectors immersive experiences combining art and nature. This strategy lowers costs and generates excitement among visitors.

In contrast, others, like Clearing Gallery, have had to close their space due to high operational costs and unsustainable rents, admitting that running a gallery requires enormous energy and drive. However, some see the current downsizing as the beginning of a new, positive phase, likening it to an evolutionary shift: “the dinosaurs were wiped out; here comes the rise of the mammals.”

To conclude, the outlook for the second half of 2025 is one of cautious optimism. Major fairs in Europe and the U.S., along with the fall auction season, will set the tone for the rest of the year. The broader message is already clear: the market is consolidating around quality, professionalism, and trust.

Final Word for Our Partners

At Artsper, we see these shifts as a call to action for galleries. The landscape may be selective, but it is also rich with opportunity. Collectors are searching for trust, expertise, and new perspectives, values that galleries are uniquely placed to provide.

As the market evolves, our mission remains to support galleries in navigating this terrain: offering visibility, tools, and insights to help you reach collectors where they are today, and where they will be tomorrow.