The art world is undergoing a generational shift. While overall sales value has dipped over the past year, the number of transactions remains steady, and younger buyers, especially Gen Z (born between 1997 - 2012), are playing a growing role in this dynamic. According to the latest Art Basel & UBS reports, global art sales in 2024 were down by roughly 12% in value but up by about 3% in volume. In other words, fewer multi-million-dollar trophies are selling, but more works are being purchased at accessible price points. This trend aligns closely with how younger collectors are entering the market.

Ken Done, Bungle Bungle, 1999 available on Artsper

1. Gen Z: Web-native, values-driven, affordability-focused

Younger collectors are not simply mini-versions of older collectors. They bring different behaviours. First of all they have a strong preference for accessibility and entry-level price points, especially prints, multiples or works from emerging artists. According to a survey conducted by MyArtBroker in February 2024, an impressive 89% of Gen Z collectors are drawn to prints by emerging artists. Additionally, Avant Arte's report indicates that the average price for prints purchased by Gen Z collectors in 2024 was around €2,000, underscoring their inclination towards affordable art options. Also we can notice a shift away from purely investment-driven collecting toward personal expression, supporting artists, authenticity and purpose. According to My Art Broker: only 7 % of Gen Z consider investment potential important when collecting art. Finally Gen Z collectors show a comfort with digital discovery, acquisition and platforms, but also an appetite for hybrid experiences (online discovery, in-person gallery visits). According to Art Basel + 1, younger collectors (millennials and Gen Z) are far more comfortable with online purchases and digital discovery.

Marcus Cederberg, Lisboa walking, 2024 available on Artsper

2. What galleries and dealers should take away

Given these observations, what are the practical implications for those working with Gen Z collectors?

- Affordable and accessible works: Galleries need to recognise that price-sensitive younger buyers are not necessarily buying trophy art, but they are participating in the market, often via prints, editions, multiples or emerging-artist works under the threshold of €50,000.

- Transparency and digital orientation: Younger collectors value clear pricing, provenance, online discovery tools, AR previews and social media engagement.

- Narrative, values and community: Artwork that connects to identity, social issues, under-represented voices and authenticity resonates with this generation. For example artists like Shirin Neshat and Hassan Hajjaj can appeal to the new generations. Collecting becomes less about status and more about meaning.

- Hybrid experience: While online channels are important, younger buyers also value in-person interaction, such as seeing works and visiting galleries. Platforms like Artsper play a key role in bridging this gap, offering digital access to artworks while complementing the traditional gallery experience. In this context, the role of the gallery is evolving toward that of a facilitator and community hub.

- Long-term relationship over quick flip: Because many Gen Z buyers are newer to collecting, engagement (education, storytelling, follow-up) matters more than the quick resale angle.

3. Is it true that “prices are lower and young people tend to buy cheaper artworks like prints or photography”?

To a large extent, yes. The data shows that younger collectors are increasingly active in more accessible price segments, with prints, multiples, and editions seeing notable growth. However, this doesn’t mean that all young buyers stick exclusively to the lowest-price works. Many still spend meaningful sums, even if they are not chasing ultra-high-end or trophy pieces.

There is a clear structural shift in the market: while the overall volume of transactions remains steady, aggregate value has declined. This indicates a trend toward more frequent, smaller-value purchases rather than fewer mega-ticket sales. It’s important to clarify that saying “prices are lower” does not imply the art market as a whole is losing value. Rather, the market is stratifying. The blue-chip segment, especially works sold at auctions above $10 million, has experienced more pressure, while the accessible tiers are growing in activity.

Prints, photography, and editions are particularly appealing to younger collectors because they offer affordability and ease of access, but they are far from the only segments drawing interest. Emerging works by artists of color and new formats such as digital art also attract attention, reflecting Gen Z’s appetite for diversity, originality, and experimentation. In general, we can highlight artists such as Shepard Fairey (Obey) and Banksy, who are very active in prints; KAWS, known for his collectible art toys; and digital artists like Paul Snell and Angela Cameron, all of whom are particularly appealing to the new generation of collectors.

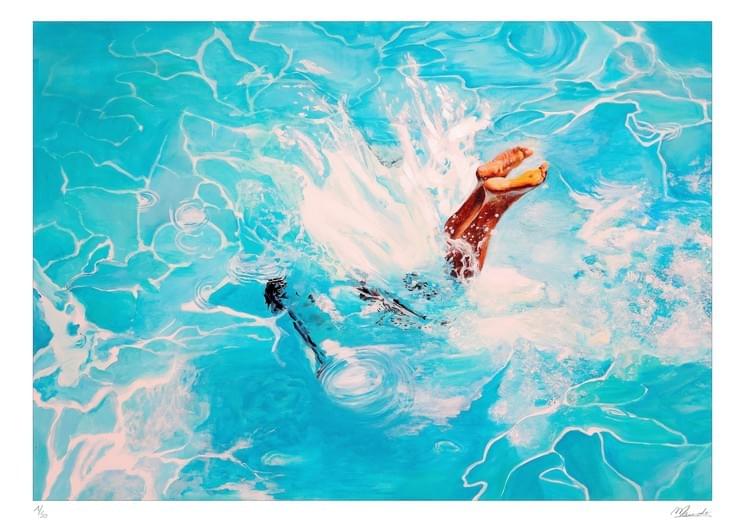

Maude Ovize, Le plongeon, 2021 available on Artsper

Conclusion

Gen Z is not just the “next generation” of collectors, they are reshaping the very landscape of the art market. For galleries, dealers, and platforms, this shift calls for more than incremental adaptation. It requires embracing digital discovery, transparent pricing, and engaging storytelling, while offering works that are accessible without compromising quality. Most importantly, it means seeing younger buyers not as one-off transactions but as the foundation of long-term relationships, building loyalty, community, and a more inclusive, sustainable art ecosystem for the future.